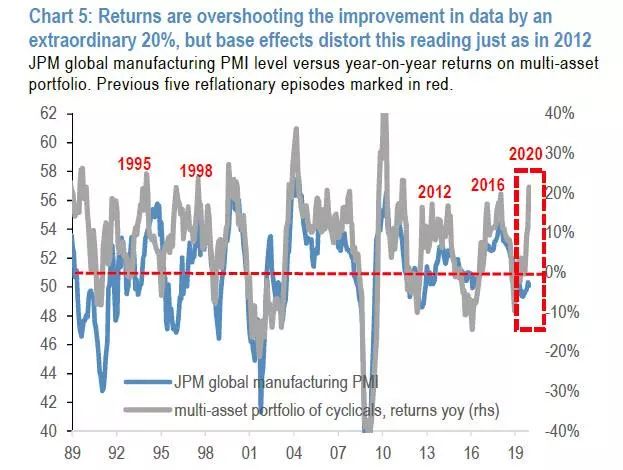

JP Morgan's analysis chart shows that without the improvement of economic fundamentals, US stocks have climbed to near "absurd" levels, and the deviation between the two has reached a record level of 20%.

According to the calculation of Faxing, since the beginning of last year, the average return of MSCI global stock market is 26%, and the average change of expected earnings per share is 1.5%. This means that the 33% return of the S & P 500 Index since January 2019 has almost all come from the expansion of valuation multiples, which is the main driving force behind central bank and big company repurchase.

Faxing analyst Andrew Lapthorne states:

The question now is how long investors can choose to ignore expensive market valuations and weak corporate earnings growth;

The data shows that in the multiple interventions of central banks in various countries after the financial crisis, the stock market rebounded despite the lack of fundamental support for corporate earnings.

But unlike the previous situation, the current valuation level has reached a higher level, which may affect the future growth of the market. Lapthorne pointed out that the expected price-earnings ratio of MSCI World in 2011 is slightly lower than 11 times, which is at the bottom of the historical range; now the expected price-earnings ratio of MSCI World has reached 17 times, which is a 55% increase from 2011, and this is based on 2020 9% EPS growth based.

This puts the beginning of the fourth quarter earnings season of US stocks in focus, Lapthorne pointed out:

Given that many companies have been working extremely hard to reduce expectations in recent months, many companies are expected to outperform expectations;

However, compared with other quarters, the report in the fourth quarter is more extensive, and the ability of enterprises to exceed expectations is often more limited;

In addition to higher-than-expected earnings per share, more emphasis should be placed on profit margins. Investors should observe whether costs continue to grow faster than sales in the United States?

POPULAR BLOG

CATEGORIES

Leave a Reply

Your email address will not be published.Required fields are marked. *